TEXAS PROPERTY CODE

TITLE 5. EXEMPT PROPERTY AND LIENS

SUBTITLE B. LIENS

CHAPTER 59. SELF SERVICE STORAGE FACILITY LIENS

SUBCHAPTER A. GENERAL PROVISIONS

Sec. 59.001. DEFINITIONS. In this chapter:

(1) "Lessor" means an owner, lessor, sublessor, or managing agent of a self-service storage facility.

(2) "Rental agreement" means a written or oral agreement that establishes or modifies the terms of use of a self-service storage facility.

(3) "Self-service storage facility" means real property that is rented to be used exclusively for storage of property and is cared for and controlled by the tenant.

(4) "Tenant" means a person entitled under a rental agreement to the exclusive use of storage space at a self-service storage facility.

Acts 1983, 68th Leg., p. 3574, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.002. APPLICABILITY. This chapter applies to a self-service storage facility rental agreement that is entered into, extended, or renewed after September 1, 1981.

Acts 1983, 68th Leg., p. 3574, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.003. APPLICABILITY OF OTHER STATUTES. (a) Subchapter B, Chapter 54, does not apply to a self-service storage facility.

(b) Unless a lessor issues a warehouse receipt, bill of lading, or other document of title relating to property stored at the facility, the following statutes do not apply to a self-service storage facility:

(1) Chapter 7, Business & Commerce Code, as amended; and

(2) Chapter 14, Agriculture Code.

Acts 1983, 68th Leg., p. 3575, ch. 576, Sec. 1, eff. Jan. 1, 1984. Amended by Acts 2001, 77th Leg., ch. 1124, Sec. 3, eff. Sept. 1, 2001.

Sec. 59.004. VARIATION BY AGREEMENT AND WAIVER. Except as expressly provided by this chapter, a lessor or tenant may not vary the provisions of this chapter by agreement or waive rights conferred by this chapter.

Acts 1983, 68th Leg., p. 3575, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.005. DAMAGES FOR VIOLATION. A person injured by a violation of this chapter may sue for damages under the Deceptive Trade Practices--Consumer Protection Act (Subchapter E, Chapter 17, Business & Commerce Code).

Acts 1983, 68th Leg., p. 3575, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.006. ATTACHMENT AND PRIORITY OF LIEN. A lien under this chapter attaches on the date the tenant places the property at the self-service storage facility. The lien takes priority over all other liens on the same property.

Acts 1983, 68th Leg., p. 3575, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.007. PURCHASE OF PROPERTY. A good faith purchaser of property sold to satisfy a lien under this chapter takes the property free of a claim by a person against whom the lien was valid, regardless of whether the lessor has complied with this chapter.

Acts 1983, 68th Leg., p. 3575, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.008. REDEMPTION. A tenant may redeem property seized under a judicial order or a contractual landlord's lien prior to its sale or other disposition by paying the lessor the amount of the lien and the lessor's reasonable expenses incurred under this chapter.

Acts 1983, 68th Leg., p. 3575, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.009. RESIDENTIAL USE. A tenant may not use or allow the use of a self-service storage facility as a residence.

Acts 1983, 68th Leg., p. 3576, ch. 576, Sec. 1, eff. Jan. 1, 1984.

SUBCHAPTER B. LIEN

Sec. 59.021. LIEN; PROPERTY ATTACHED. A lessor has a lien on all property in a self-service storage facility for the payment of charges that are due and unpaid by the tenant.

Acts 1983, 68th Leg., p. 3576, ch. 576, Sec. 1, eff. Jan. 1, 1984. Amended by Acts 1985, 69th Leg., ch. 117, Sec. 12(a), eff. Sept. 1, 1985.

SUBCHAPTER C. ENFORCEMENT OF LIEN

Sec. 59.041. ENFORCEMENT OF LIEN. (a) Except as provided by Subsection (b) of this section, a lessor may enforce a lien under this chapter only under a judgment by a court of competent jurisdiction that forecloses the lien and orders the sale of the property to which it is attached.

(b) A lessor may enforce a lien under this chapter by seizing and selling the property to which the lien is attached if:

(1) the seizure and sale are made under the terms of a contractual landlord's lien as underlined or printed in conspicuous bold print in a written rental agreement between the lessor and tenant; and

(2) the seizure and sale are made in accordance with this chapter.

Acts 1983, 68th Leg., p. 3576, ch. 576, Sec. 1, eff. Jan. 1, 1984. Amended by Acts 1985, 69th Leg., ch. 117, Sec. 12(c), eff. Sept. 1, 1985.

Sec. 59.042. PROCEDURE FOR SEIZURE AND SALE. (a) A lessor who wishes to enforce a contractual landlord's lien by seizing and selling or otherwise disposing of the property to which it is attached must deliver written notice of the claim to the tenant.

(b) If the tenant fails to satisfy the claim before the 15th day after the day that the notice is delivered, the lessor must publish or post notices advertising the sale as provided by this subchapter.

(c) If notice is by publication, the lessor may not sell the property until the 15th day after the day that the first notice is published. If notice is by posting, the lessor may sell the property after the 10th day after the day that the notices are posted.

Acts 1983, 68th Leg., p. 3576, ch. 576, Sec. 1, eff. Jan. 1, 1984. Amended by Acts 1984, 68th Leg., 2nd C.S., ch. 18, Sec. 5, eff. Oct. 2, 1984; Acts 1985, 69th Leg., ch. 117, Sec. 12(d), eff. Sept. 1, 1985.

Sec. 59.043. CONTENTS AND DELIVERY OF NOTICE OF CLAIM. (a) The lessor's notice to the tenant of the claim must contain:

(1) an itemized account of the claim;

(2) the name, address, and telephone number of the lessor or the lessor's agent;

(3) a statement that the contents of the self-service storage facility have been seized under the contractual landlord's lien; and

(4) a statement that if the claim is not satisfied before the 15th day after the day that the notice is delivered, the property may be sold at public auction.

(b) The lessor must deliver the notice in person or by certified mail to the tenant's last known address as stated in the rental agreement or in a written notice from the tenant to the lessor furnished after the execution of the rental agreement. Notice by mail is considered delivered when the notice, properly addressed with postage prepaid, is deposited with the United States Postal Service.

Acts 1983, 68th Leg., p. 3577, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.044. NOTICE OF SALE. (a) The notice advertising the sale must contain:

(1) a general description of the property;

(2) a statement that the property is being sold to satisfy a landlord's lien;

(3) the tenant's name;

(4) the address of the self-service storage facility; and

(5) the time, place, and terms of the sale.

(b) The lessor must publish the notice once in each of two consecutive weeks in a newspaper of general circulation in the county in which the self-service storage facility is located. If there is not a newspaper of general circulation in the county, the lessor may instead post a copy of the notice at the self-service storage facility and at least five other conspicuous locations near the facility.

Acts 1983, 68th Leg., p. 3577, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.045. CONDUCT OF SALE. A sale under this subchapter must be a public sale at the self-service storage facility or a reasonably near public place. The lessor must conduct the sale according to the terms specified in the notice advertising the sale and sell the property to the highest bidder.

Acts 1983, 68th Leg., p. 3578, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.046. EXCESS PROCEEDS OF SALE. If the proceeds of a sale under this subchapter are greater than the amount of the lien and the reasonable expenses of the sale, the lessor shall deliver written notice of the excess to the tenant's last known address as stated in the rental agreement or in a written notice from the tenant to the lessor furnished after the execution of the rental agreement. The lessor shall retain the excess and deliver it to the tenant if the tenant requests it before two years after the date of the sale. If the tenant does not request the excess before two years after the date of the sale, the lessor owns the excess.

Acts 1983, 68th Leg., p. 3578, ch. 576, Sec. 1, eff. Jan. 1, 1984.

Sec. 59.047. ADDITIONAL PROCEDURES FOR SALE OF CERTAIN PROPERTY. A holder of a lien under this chapter on a motor vehicle subject to Chapter 501, Transportation Code, or on a motorboat, vessel, or outboard motor for which a certificate of title is required under Subchapter B, Chapter 31, Parks and Wildlife Code, may follow the procedures prescribed by Section 70.006 in addition to the procedures prescribed by this chapter.

Added by Acts 1999, 76th Leg., ch. 70, Sec. 1, eff. Sept. 1, 1999.

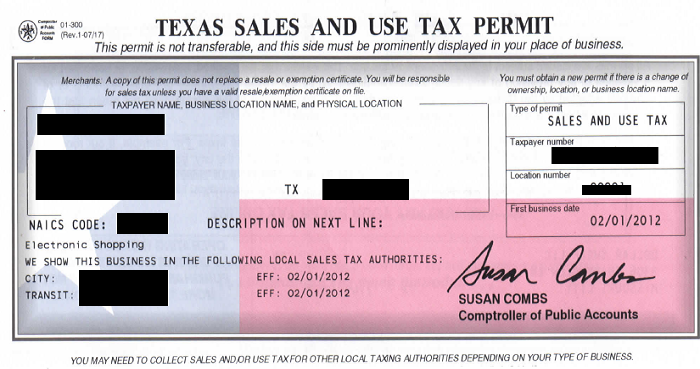

Texas SB 690 and HB 1259

Actions: (descending date order)

01/01/2012 Effective Date

6/17/2011 E Signed by the Governor

Description Comment Date Time Journal Page

S House passage as amended reported 05/16/2011 2337

H Record vote RV#1103 05/13/2011 3962

H Passed 05/13/2011 3962

H Read 3rd time 05/13/2011 3962

H Rules suspended 05/13/2011

H Passed to 3rd reading as amended 05/12/2011 3792

H Amended 1-Kolkhorst 05/12/2011 3792

H Read 2nd time 05/12/2011 3792

H Laid out in lieu of companion HB 1259 05/12/2011 3792

H Committee report sent to Calendars 04/20/2011

H Committee report distributed 04/19/2011 07:42 PM

H Comte report filed with Committee Coordinator 04/19/2011 2091

H Reported favorably w/o amendment(s) 04/13/2011

H Considered in formal meeting 04/13/2011

H Referred to Business & Industry 04/04/2011 1482

H Read first time 04/04/2011 1482

H Received from the Senate 03/28/2011 1098

S Reported engrossed 03/24/2011 790

S Record vote 03/24/2011 759

S Passed 03/24/2011 759

S Read 3rd time 03/24/2011 759

S Record vote 03/24/2011 758

S Three day rule suspended 03/24/2011 758

S Vote recorded in Journal 03/24/2011 758

S Read 2nd time & passed to engrossment 03/24/2011 758

S Rules suspended-Regular order of business 03/24/2011 758

S Placed on intent calendar 03/23/2011

S Committee report printed and distributed 03/09/2011 02:32 PM

S Recommended for local & uncontested calendar 03/09/2011

S Reported favorably as substituted 03/09/2011 515

S Considered in public hearing 03/08/2011

S Left pending in committee 03/01/2011

S Testimony taken in committee 03/01/2011

S Considered in public hearing 03/01/2011

S Scheduled for public hearing on . . . 03/01/2011

S Referred to Business & Commerce 02/23/2011 415

S Read first time 02/23/2011 415

S Filed 02/14/2011

S Received by the Secretary of the Senate 02/14/2011

{pdf}http://www.legis.state.tx.us/tlodocs/82R/billtext/pdf/SB00690E.pdf|height:700|width:600|app:google{/pdf}

Effective date

Section 39, Article III, Texas Constitution, provides that “No law passed by the Legislature, except the general appropriation act, shall take effect or go into force until ninety days after the adjournment of the session at which it was enacted, unless the Legislature shall, by a vote of two-thirds of all the members elected to each House, otherwise direct.” If an act does not specify an effective date, the act becomes effective on the 91st day after the date of final adjournment.

If the act specifies an effective date earlier than the 91st day after adjournment, and the effective date rule is suspended, the act becomes effective on the specified date. If the act specifies that it has immediate effect, and the effective date rule is suspended, the act becomes effective on the date of the last action necessary for it to become law, which is: (1) the date the governor approves the act; (2) the date the governor files the act with the secretary of state (having neither approved nor vetoed it); (3) the date the appropriate period for gubernatorial action expires, if the governor fails to act within that period (Section 14, Article IV, Texas Constitution); or (4) in the event of a veto, the date the veto is overridden.

The act can specify an effective date after the 91st day after adjournment without suspending the effective date rule, make the effective date contingent on an event or the expiration of a specified period after that event takes place, or make it contingent on the adoption of a proposed constitutional amendment. Parts of a bill can take effect on different dates, or particular sections or applications of an act may be delayed or accelerated.