Emily recently asked the following question:

What is the state requirement for sales tax, is it required or not? I have heard different stories.

Emily, as far as the sales tax is concerned, you have a few different options. Let me start out by saying that I'm not an accountant or an attorney and you should consult with a professional if you have specific question regarding this issue.

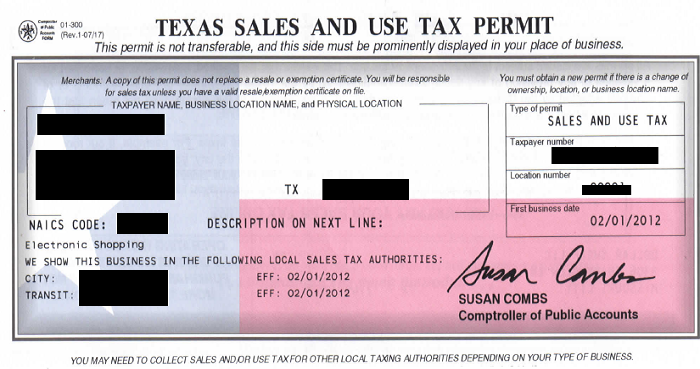

If you don’t already have one, you can apply for a sales tax use permit on the Comptroller’s website. With a sales tax use permit, you don't pay sales tax when you purchase a storage unit, but you are responsible for collecting sales tax on everything you sell. If you don't have a sales tax use permit, you will need to obtain one or pay sales tax on any storage units that you buy. Even if you pay sales tax up front, you must still collect or pay sales tax on everything you sell.

If you are asking whether you have to pay sales tax or not, the answer is yes. Sure, this is an all cash business, and some people do try to cheat, but why take that chance? Records are being kept by the storage facilities and the auctioneers of every storage unit purchased. This information could be used against you if you ever got audited by the state.

I hope this answered your question.

Good Afternoon,

I wanted to see if you knew anything about how to obtain a reseller sales tax exempt certificate? Or if this type of exemption applies to the resell of storage auction contents. Thank you in advance for all of your help!!!